Plutocrats, Chrystia Freeland’s 2013 book, is about the rise of the “global super-rich” and the ways the global economy squeezes the middle classes in development countries. Freeland argues that “we are living through two, slightly different gilded ages that are unfolding simultaneously. The industrialized West is experiencing a second gilded age. . . . the emerging markets are experiencing their first gilded age.”

Take the second first: “Many countries in Asia, Latin America, and Africa are industrializing and urbanizing, just as the West did in the nineteenth century, and with the added oomph of the technology revolution and a globalized economy.” As in the first Gilded Age, “The people at the very top of all of the emerging economies are benefiting most,” but at the same time “the transition is also pulling tens of millions of people into the middle class and lifting hundreds of millions out of absolute poverty.”

She observes that one of the main engines of this emerging-market gilded age was “a political revolution—the collapse of communism and the triumph of the liberal idea around the world,” which has been just as important as technological innovation. Because of this technology, and because of the money and experience of the developed world, “the first gilded age of the developing world is proceeding much faster than it did in the West in the nineteenth century.”

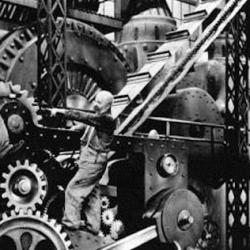

At the same time, the developed world is going through a second gilded age. This is partly driven by technical achievement: “Just as the machine age transformed an economy of farm laborers and artisans into one of combine harvesters and assembly lines, so the technology revolution is replacing blue-collar factory workers with robots and white-collar clerks with computers.”

But “the West is also benefiting from the first gilded age of the emerging economies.” Companies that run into trouble have options today that they didn’t have prior to globalization. She quotes Professor Michael Porter: “Companies perceive that they can do fine and they can do fine by being one of the 84 percent that moved offshore, and they can also do fine by cutting wages.”

This is good for companies and their upper echelons, not so good for the American middle class. After reviewing who got rich from the iPod (mostly American executives), she concludes: “The populist fear that even America’s most brilliant innovations are creating more jobs abroad than they are at home is clearly true. In fact, the reality may be even grimmer than populist critics realize, since more than half of the American iPod jobs are relatively poorly paid and low skilled.”

Many are being squeezed between the two gilded ages.